Introduction

Real estate is a lucrative investment, and many investors always look for the best investment opportunities. One of the crucial factors to consider when investing in real estate is whether the property is balloted or non-balloted. A comparison of balloted and non-balloted plots in real estate will be discussed in this article.

Balloted Plots

Balloting is a process used by real estate developers to allocate plots to their customers. During this process, the developer assigns a unique number to each plot and then draws the numbers randomly to determine which customer will get which plot. Transparency is ensured by having an independent auditor present during every process step.

When you invest in a balloted plot, you will know exactly where your plot is located. The developer will have built the basic infrastructure for the allocated area, including roads, water supplies, and electricity. The advantage of investing in a balloted plot is that you can start construction immediately, and your property value may increase significantly over time.

Non-Balloted Plots

Non-balloted plots, on the other hand, are plots still need to be allocated to customers. In other words, you will know the location of your plot once the developer has completed the balloting process. As a result, starting construction may take some time.

The advantage of investing in a non-balloted plot is that it is usually cheaper than a balloted plot. However, there are risks involved, such as delays in the balloting process or the developer needing to complete the basic infrastructure in the allocated area.

Plot and Plot File

Investments in real estate are two ways: a physical plot or a plot file. A physical plot is a piece of land that is physically available, whereas a plot file is a document that represents a specific plot, but the actual piece of land is not yet available.

A plot file can be an excellent investment opportunity for those who want to invest in a balloted plot but need more financial resources to buy it outright. In this case, investors purchase the plot file, and the developer will allocate a plot number to the file. Once the balloting process is complete, the investor can either pay the remaining amount and get physical possession of the plot or sell the file at a profit.

Reasons to Invest

There are several reasons to invest in real estate, including:

Tangible Asset: Real estate is a tangible asset that you can see, touch, and feel. Investing in such a scheme gives investors a sense of security.

High Returns: Real estate has the potential to generate high returns over the long term, and it can be a good source of passive income.

Diversity: Real estate investing can reduce the overall risk of your investment portfolio by diversifying your holdings.

Hedge Against Inflation: Real estate can act as a hedge against inflation because the property value usually increases over time.

Process

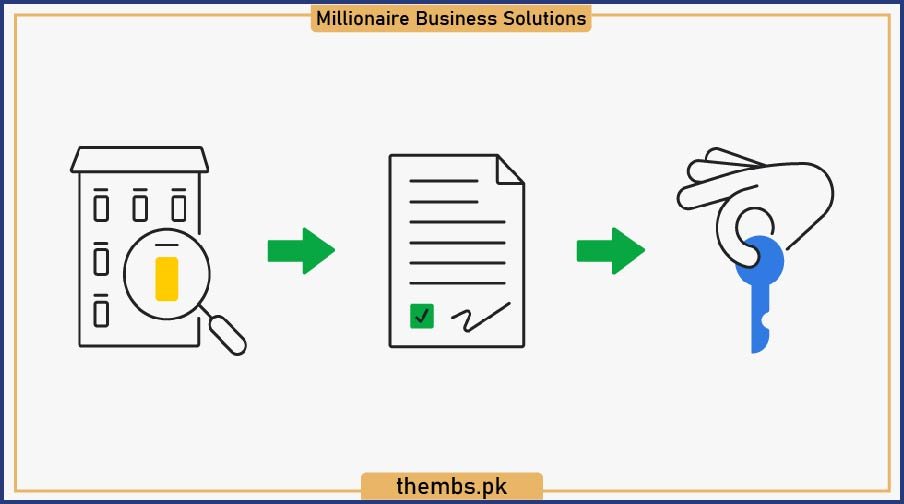

The process of investing in a plot or plot file involves the following steps:

Research: The first step is to research the market and understand the different investment opportunities available.

Budget: Establish your budget and invest the amount you can afford.

Location: Identify the location you want to invest in based on factors such as proximity to public transportation, schools, and markets.

Developer: Choose a reputable developer with a good track record of completing projects on time.

Documentation: Ensure all documentation is in order, including the sale agreement, payment receipts, and allotment letter.

Registration: Get the property registered in your name and pay all the associated fees.

Types

In addition to balloted and non-balloted plots, there are several other types of plots available in the real estate market, including:

Residential Plots: Plots that are zoned for residential purposes, such as houses and apartments.

Commercial Plots: Ideal for shops and offices, commercial plots are zoned for commercial use.

Agricultural Plots: Plots used for agriculture, such as farming and livestock rearing.

Industrial Plots: Facilities such as factories and warehouses are on industrial plots.

Investing goals and risk appetite should be considered when choosing a plot.

Key Differences Between Balloted and Non-Balloted Plots

Location: With a balloted plot, you will know the exact location of your plot, while with a non-balloted plot, you will have to wait for the balloting process to be completed.

Construction: With a balloted plot, you can start building immediately after the balloting process, while with a non-balloted plot, you may have to wait a while before beginning construction.

Infrastructure: With a balloted plot, the developer will have completed the basic infrastructure, while with a non-balloted plot, there is a risk that the developer may need to complete the infrastructure in the allocated area.

Price: Non-balloted plots are usually cheaper than balloted plots, but this may be offset by the risks involved.

Conclusion

Investing in real estate can be lucrative, but it is important to understand the differences between balloted and non-balloted plots. Balloted plots are more expensive but offer immediate construction, a known location, and completed infrastructure. Non-balloted plots are cheaper but have risks, including delays and incomplete infrastructure. To determine which type of plot to invest in, you need to weigh the pros and cons of each option.